The Learning Platform That Helps Developers Grow Into Experts

Frontend Masters is built by developers for developers. Learn from engineers at companies like Netflix, Stripe, and Google through in-depth courses and guided learning paths across frontend, backend, DevOps, and AI. If you’re leveling up skills, preparing for a promotion, or moving into full-stack work, this is where you get the depth and structure casual tutorials never provide.

250+ in-depth courses built for working developers

Learn from engineers who actually use the tools they teach. With 250+ courses across frontend, backend, DevOps, and AI, you'll go deeper than surface-level walkthroughs. From JavaScript and React to Go, Python, C, databases, containers, and cloud engineering, every course is designed to give you skills you can apply in real projects.

Search by technology, filter by experience level, or jump straight into the topics that match your stack and career goals.

24 Guided roadmaps for every developer journey

Learning paths are one of the most loved parts of Frontend Masters. Each path is a sequenced set of courses that helps you advance from where you are today to where you want to be next, whether that means mastering the basics, moving into full-stack work, or exploring advanced topics like performance, AI, or cloud engineering.

You can also build a custom learning path by choosing the topics and technologies you want to focus on and adjusting the priority of each course. Save your path and start working toward your next skill milestone.

A learning experience built for engineers, not passive viewers

Our custom player is designed to help you retain what you learn and revisit it fast. Lessons include built-in quizzes and flashcards, searchable transcripts, timestamped notes, and an in-player Q&A module for asking questions or giving feedback.

Playback speed control, keyboard shortcuts, and 4K streaming make learning efficient whether you're at your desk, on a second monitor, or watching from your phone.

Show your progress and share your expertise

Every course comes with a completion certificate you can download, store in your learning library, and share on LinkedIn or with your team. Certificates are available in light and dark themes and serve as proof of the skills you've built and the time you've invested in professional growth.

They are especially useful when you're preparing for a review cycle, applying for a new role, or building a promotion case.

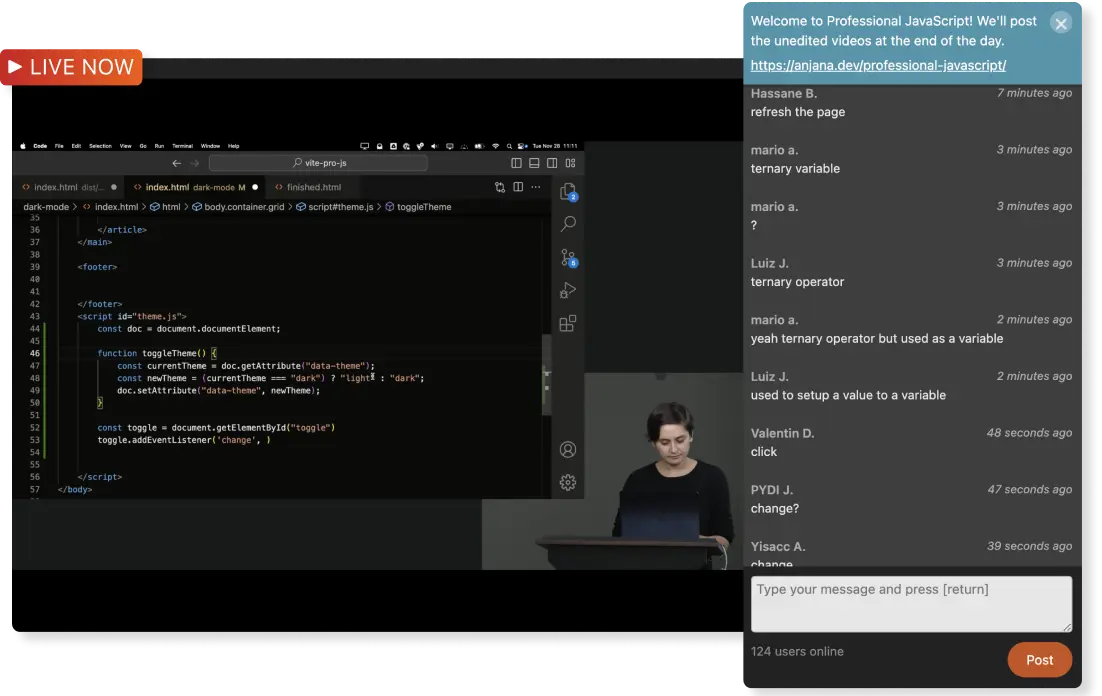

Learn live with industry experts

When new courses are recorded, we stream them live so members can follow along in real time, ask questions, and interact directly with the instructor. It feels like being in the room without traveling to a conference or paying for an expensive workshop ticket.

Learn Straight from the Experts Who Shape the Modern Web

250+ Courses Curated into 24 Learning Paths

Frequently Asked Questions

Free trials are not available at this time. We have the following opportunities to learn for free:

- The online bootcamp is a free, two-week curriculum to get you started with web development.

- You can create a free account to gain access to five full courses for free.